RSI vs Stochastic Oscillator: Key Differences

In technical analysis, traders use technical indicators to help them make sense of price action and momentum, gain insights into market sentiment, and identify opportunities for buying and selling assets. Some tools highlight short-term and long-term trends, identify overbought and oversold conditions, assess financial volume behind price movements, and many others.

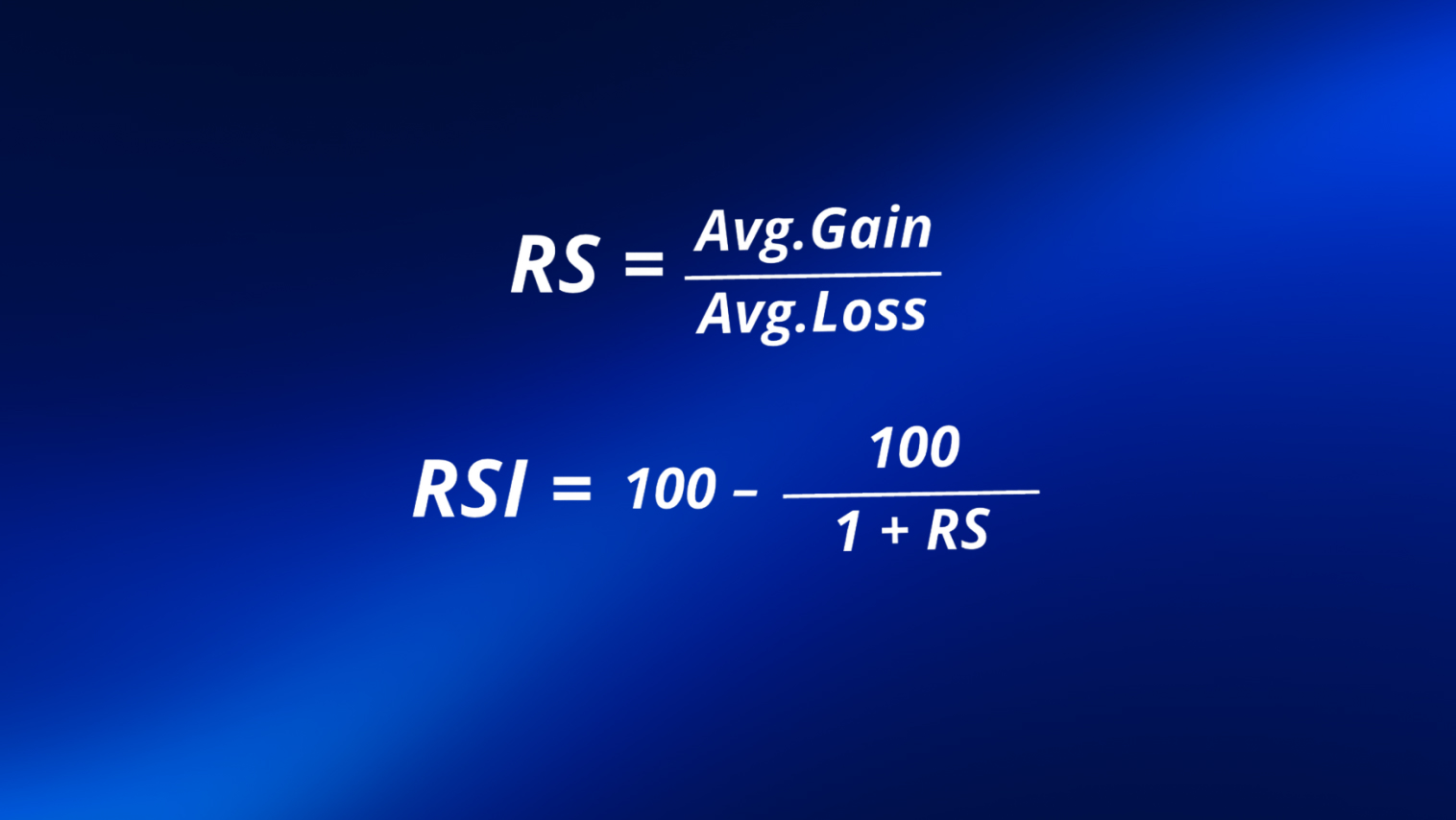

The Relative Strength Index (RSI) is a widely used momentum oscillator developed by American mechanical engineer Welles Wilder Jr. and introduced in 1978. To put it simply, the RSI measures the speed and magnitude of an asset’s most recent price changes to evaluate whether it is overbought or oversold. It compares the average of down moves to the average of up moves over a defined period, which by default is 14. Here’s how the RSI is calculated:

By observing the RSI, you can gain relevant insights into market conditions to trace a trading strategy. For example, an RSI above 70 indicates overbought conditions and can be a warning that prices have risen too far too quickly and may be due for a pullback. On the other hand, an RSI reading below 30 suggests oversold conditions, and prices may rebound at any moment.

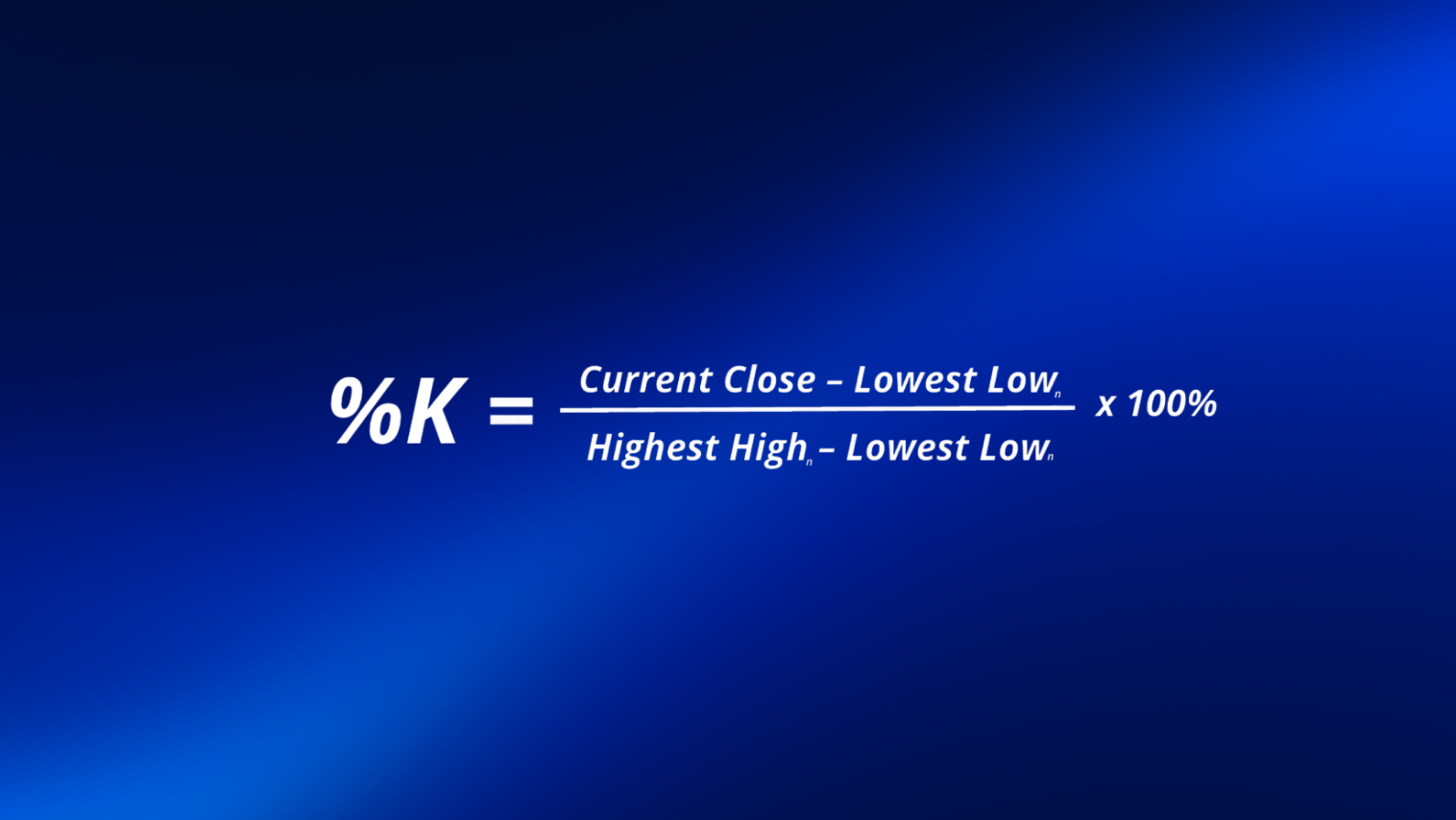

The Stochastic Oscillator is yet another momentum indicator created by George Lane in the late 1950s. While the RSI looks at average price gains and losses, the stochastic oscillator compares the latest closing price to the most recent trading range (i.e., the highest high and the lowest low). According to Lane’s premises, prices tend to close near the highest high of the period in an uptrend, while the opposite is true in a downtrend.

Although both RSI and stochastic indicators are mainly used to identify overbought and oversold conditions, they do so in different ways. The differences between the two indicators can be summarized as:

In the example below, you can observe how the RSI (with a moving average highlighted by the yellow line) remains relatively stable between 50 and 70 during an uptrend, briefly dipping during corrections but not frequently reaching extremes. The stochastic oscillator, however, shows much sharper movements, regularly swinging between overbought and oversold zones. This shows how the RSI provides smoother trend confirmation, while the stochastic is more responsive to short-term fluctuations.

The comparison table below should help you highlight the main differences between both.

| Aspect | RSI | Stochastic |

| Calculation Base | Momentum of price movements (average gains vs average losses) | Position of the closing price within a recent high-low range |

| Formula | RS = average gain/average loss

RSI = 100 – 100/(1 + RS) |

%K = (Close – Lowest Low)/(Highest High – Lowest Low) x 100

%D = 3-Period SMA of %K |

| Overbought Level | Above 70 | Above 80 |

| Oversold Level | Below 30 | Below 20 |

| Use Cases | Confirming trend strength; spotting divergence; and identifying possible trend reversal levels. | Useful in identifying reversals in range-bound markets; entry and exit points during short-term swings; and quicker reactions for price movements under oversold or overbought conditions. |

| Sensitivity | Slower and smoother changes. Fewer signals, filtering out noises. | Faster and more volatile. Provides more entry signals but also generates more false signals. |

Advantages: People like using RSI due to its smooth calculation, and effectiveness in reducing false signals. Since it is based on averaged gains and losses, this indicator is considered much less sensitive to market noise, making it excellent for confirming trends and giving more trustworthy signals. During bullish trends, RSI values typically stay above 50, displaying strength. In bear markets, values remain below that same threshold. Traders also use the RSI to quickly spot divergences, where price and RSI diverge on the price chart, opening opportunities for potential buy and sell signals. It is straightforward, clearly marking key zones for identifying overbought and oversold conditions, offering an intuitive view of the market.

In the image above, it is possible to see the indicator pointing towards a divergence between the price and the RSI. Prices are not able to stay above the $105,959 level. This is one of the use cases of the RSI to help you spot divergences and weakening momentum.

Disadvantages: The RSI indicator can be somewhat less effective when explosive market movements occur, usually lagging behind sharp price reversals due to its smoothing effect. In strong trends, it can also remain under overbought or oversold conditions for extended periods, making these signals less significant without a broader context. Those who only plan their entries and exits solely based on the extreme zones of the RSI may end up opening several losing trades. Besides that, the RSI tends to perform much poorly during sideways markets, frequently staying around neutral levels and offering fewer opportunities to oscillators like the stochastics. The default 14-period RSI might also not be ideal for all markets or timeframes, requiring the trader to experiment and try different parameters before jumping straight to live markets trading.

We have many erratic signals during range-bound markets and an overall lack of direction. The RSI bounces up and down its moving average.

Advantage: The stochastic oscillator is a momentum indicator highly valued for its responsiveness. It can quickly capture small shifts in momentum by showing where the price closed within the most recent range. It can be especially useful in sideways markets, offering clear signals when the %K line crosses above or below the %D line in oversold or overbought zones. Not only that, but it is relatively intuitive, making it easier to identify and interpret short-term moves compared to other oscillators. It also offers relevant insights when it detects divergences between the stochastic and price, signaling a weakening momentum to trends before a reversal happens early.

The image above shows examples of divergences, as well as long and short signals given the line crossings in key points.

Disadvantages: The sensitivity of the stochastic oscillator can become problematic in strongly trending markets, where it can frequently give false signals. This can mislead traders into premature entries, especially if they don’t use additional technical analysis tools to confirm the direction of the trend. Its performance heavily depends on choosing the right settings for a certain period. Too short periods cause excessive noise; too long diminishes its responsiveness. To mitigate these issues, traders may combine stochastic signals with a broader trend indicator, adjusting its parameters, or choosing to ignore signals against the main trend.

On well-established trends, the stochastic oscillator might give fewer relevant signals and not offer the right alerts to highlight the most optimal time to buy or sell assets.

Generally speaking, the RSI can be used in markets with a clear trend. In bullish markets, the RSI tends to remain elevated, oscillating between 40 and 80. Pullbacks during uptrends might only bring it down to the 40-50 zone before it goes back up, helping traders identify optimal points for adjusting their position or entering an uptrend in course. In bearish markets, it tends to stay suppressed between 20 and 60. Overall, an RSI above 50 indicates a strong bullish control over price, whereas below 50 suggests that bears are in control. Traders use the RSI to identify the main trend and avoid counter-trend trades.

In choppy, sideways markets, the stochastic oscillator outperforms the RSI. When the price oscillates between support and resistance levels, momentum oscillators like RSI might not reach relevant thresholds clearly, but the stochastic will capture these price swings more effectively. Trading strategies based on buying low and selling high with consolidation ranges benefit greatly from stochastic signals. In a horizontal channel, you can find buy and sell signals whenever the %K line crosses above or below the %D line when they are both near the 20 or 80 thresholds. In the same scenario, the RSI would hang around the 40–60 levels, not giving many relevant signals.

For day traders, the stochastic oscillator can be particularly helpful. It might give you more frequent signals when dealing with smaller price swings and more quickly provide relevant insights into the next price move. On the other hand, the RSI might be more suitable for long-term swing trading strategies.

Effective interpretations of the Relative Strength Index and the stochastic oscillator are all about understanding context and confirmation, not simply the values you see in the indicator charts. Here are some tips to better use both of these indicators:

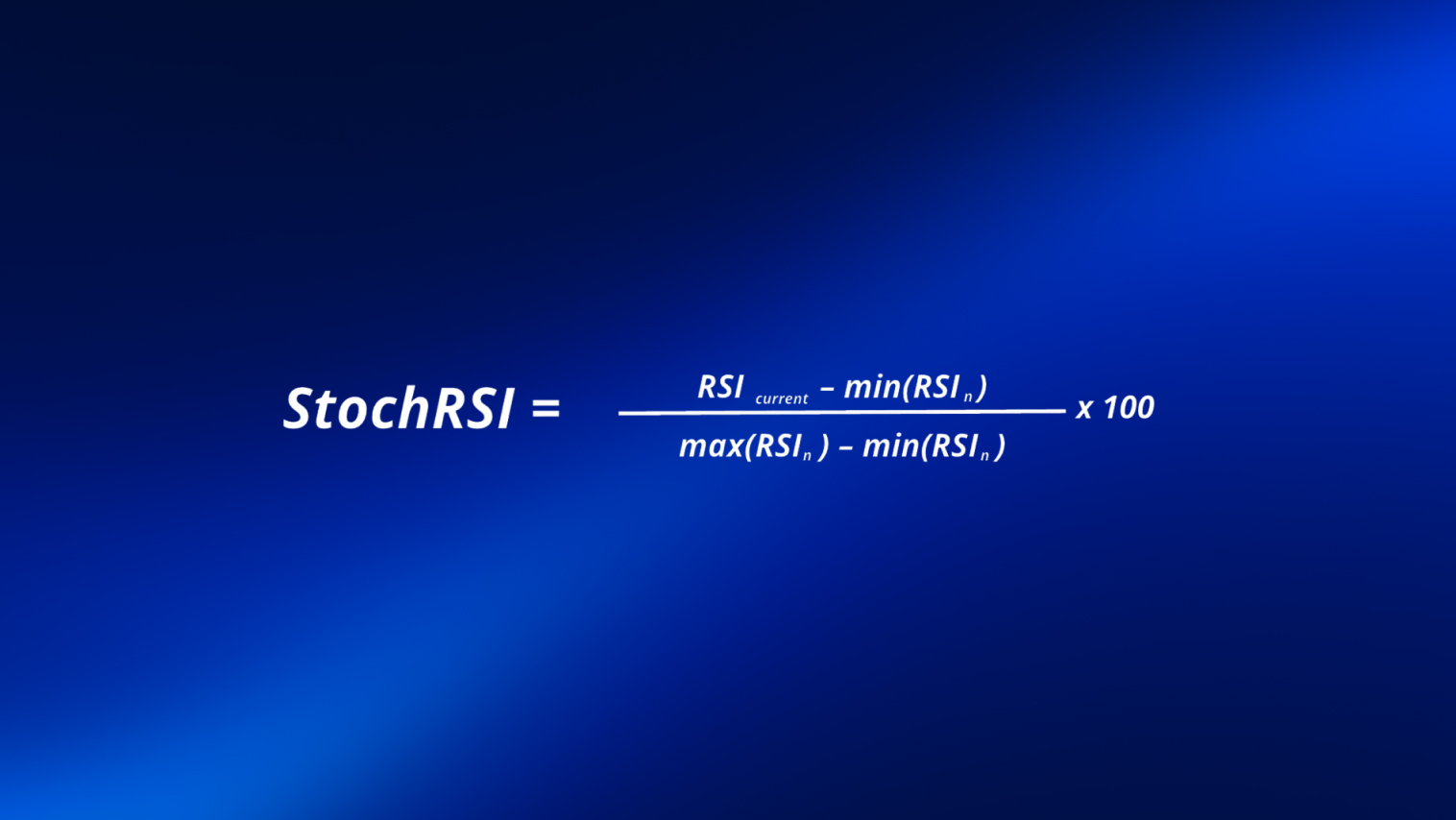

The stochastic RSI can provide a hybrid approach for those who wish to extract the best from both the RSI and stochastic oscillator. It works by applying the stochastic formula to the RSI values rather than directly to the price. Treaders use the stochastic RSI indicator to catch turns in momentum even faster. Its formula for a given period n is:

Just like the regular stochastic, the StochRSI outputs a value between 0 and 100. It will, in practice, seem even more volatile than the standard oscillator, with amplified movements.

Traders use the stochastic RSI mainly for its quick responsiveness compared to standard RSI. While the RSI might not signal oversold after a moderate drop, StochRSI can rapidly fall below 20 and capture momentum shifts. It is also quite useful in range-bound markets, highlighting subtle moves and offering short-term trading opportunities. In strong, directional trends, you can use stochastic RSI for capturing smaller counter-trend swings.

Although good for some, we must consider that the heightened sensitivity of this indicator increases its volatility. It can generate an excessive amount of signals, making room for too much noise. Its quick and fast nature can make traders mistakenly assume the market is preparing for significant price action when it is actually minimal. Moreover, StochRSI requires something to reduce all the noise, such as additional indicators or moving averages, even furthering the complexity of its use.

Both the RSI and stochastic indicators are extremely helpful tools, but improper use can hurt performance. Here’s how they can go wrong—and how to avoid pitfalls.

Both the RSI and stochastic oscillator are powerful indicators to add to your trading system. Each offers unique insights into momentum and helps traders detect potential turning points in price trends. The RSI provides a smoother view of trend strength by comparing average gains to average losses. It is especially useful in trending markets, helping in identifying when momentum aligns or diverges from price action. On the other hand, the stochastic oscillator offers speed and higher sensitivity to short-term price movements. It efficiently pinpoints entries and exits within a trading range through its dual-line system, reacting much quicker to price fluctuations. For retail traders, the RSI indicator’s simplicity might be a better fit for confirming broader trends, while the stochastic might be ideal for those comfortable interpreting a higher number of signals.

Although both these indicators have key differences and traits, you can benefit from using them in combination, leveraging their complementary strengths. The RSI is effective in filtering out noise from the rapid movements of the stochastic, while it provides more timely triggers for entering trades.

No single indicator alone is a guarantee of success. Both the RSI and stochastic oscillators work best when applied alongside a complete trading system that incorporates trend analysis, risk management, and other tools for confirmation. To improve your chart reading in trading, you must also take a look at other popular momentum indicators.