RSI vs MACD - Which One is the Best Indicator for Trading?

Both the MACD and RSI are among the most popular technical indicators traders use to gain insights into market momentum and highlight potential trend reversals. The Moving Average Convergence Divergence, commonly referred to as MACD, is a trend-following momentum indicator, while the Relative Strength Index, also known as RSI, is a momentum oscillator that measures the speed of change in price. Although both indicators are valuable tools for any trading system, it is important to know how and when to use them for a more effective trading strategy.

The Relative Strength Index, or RSI, originated in the 1970s when J. Welles Wilder Jr. developed it as a momentum oscillator. It is widely used in technical analysis to measure the speed and magnitude of price movement over time. The RSI indicator moves on a scale from 0 to 100, helping traders identify overbought or oversold conditions based on averaged recent gains and losses. Its default n period is 14 and it is calculated as below:

Overall, an RSI value above 50 indicates that price action has been mostly bullish, while a value below 50 suggests a more bearish momentum. The RSI indicates an overbought condition when it rises above 70 and an oversold condition when it drops below 30. These thresholds indicate a potential reversal in both trending and range-bound markets. Some traders use custom levels like 80 and 20 for more volatile assets, such as crypto.

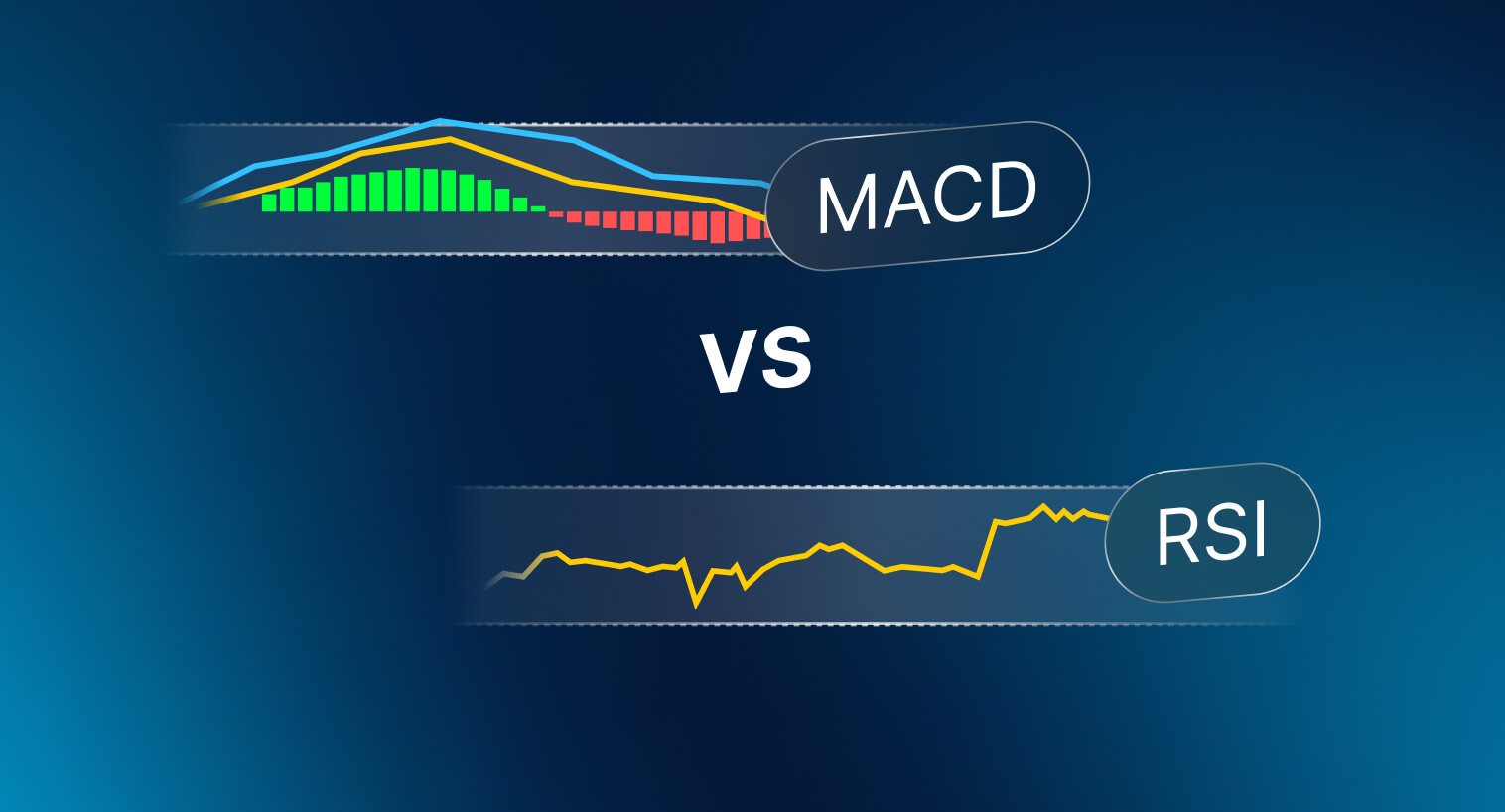

The RSI is especially helpful in highlighting entry or exit points. An RSI crossing down from 70 may be a signal that bears took control over price, whereas a move up from 30 can be interpreted as a bullish signal. Using the RSI to find market divergences is also common. Divergences happen when the price makes new highs or lows, but the indicator doesn’t follow, pointing toward weakening momentum. While prices are rising, the RSI may show lower highs. This behavior may serve as an alert that bearish could be gaining force.

Although useful for finding reversal zones, the RSI can remain under overbought or oversold conditions for extended periods when strong trends emerge. For this reason, it is essential to use additional tools and indicators to reduce the amount of false signals.

The divergence between the price and indicator in the USDEUR preceded a price drop.

Developed by Gerald Appel in the 1970s, the Moving Average Convergence Divergence, mostly referred to as MACD, is a trend-following momentum indicator helpful in identifying changes in market trends and potential trend reversals. It is based on the relationship between two exponential moving averages of an asset’s price, a 12-period EMA and a 26-period EMA, by default. The main elements of the MACD indicator are as follows:

MACD signals are generated whenever the MACD line crosses above the signal line for bullish signals or crosses below the signal line for bearish signals. These crossovers are especially relevant when they occur when the MACD line is near or below zero, an area seen as key for identifying trend shifts. A crossover above zero usually suggests a good time to buy amid a pullback. A drop below, on the other hand, may be a sign of a downtrend emerging.

The MACD histogram tells us whether momentum is accelerating or decelerating. Larger bars above zero reflect a strong bullish momentum. Smaller bars, on the other hand, indicate that the trend is losing strength. Negative bars growing downward illustrate increasing bearish strength, even if prices are still rising. Just like the RSI, you can use the MACD to find divergence and use it to anticipate potential price reversals, especially when confirmed by price action or support and resistance levels.

Since MACD relies heavily on moving averages, it may be slow to take in fast, explosive price moves. It does extremely well, however, in trending markets, frequently excelling at confirming longer trends, while the RSI pinpoints extremes.

The blue MACD line crossing below the signal line with the histogram increasingly red and below zero allows us to go short when prices pull back to higher levels before dipping further.

Both RSI and MACD are momentum-based indicators. They are calculated differently and may serve different purposes. Below, we summarize their main traits and differences:

| Aspect | RSI | MACD |

| Indicator Type | Momentum oscillator. Measures speed of price changes. | Trend-following momentum indicator. Measures convergence and divergences of two moving averages. |

| Calculation | Based on average gains and losses over a lookback period. | Based on the difference between two EMAs (MACD line) and an EMA of that difference (Signal Line). |

| Value Range | 0 to 100, where 70 indicates overbought and 30 indicates oversold. | Not a fixed range. It oscillates above or below 0. It doesn’t really have fixed values for overbought/oversold levels. |

| Primary Signal | Crossovers key levels (30, 50, and 70) are used to identify trend shifts. Divergences can indicate weakening momentum. | Crossover signals indicate momentum shifts. Zero-line crossovers indicate changes in trends. Divergences can also indicate trend reversals early. |

| Strengths | Excels in sideways markets. | Excels in trending markets. |

| Weaknesses | May give false signals when trends are extremely strong. | May be slower to track explosive movements. Lots of false signals in directionless markets. |

| Best Suited For | Identifying overbought and oversold conditions. | Identifying and confirming trend direction and momentum. Useful for entry and exit timing in trending markets. |

| Visual Appearance | Single oscillating curve with reference lines (30 and 70). Easy to spot extreme levels. | Two lines that converge/diverge, plus a histogram. The zero line serves as a baseline. |

The RSI can be described as a leading indicator for potential reversals, whereas the MACD is more of a lagging indicator that confirms a trend or shift once it is underway.

The RSI excels in sideways markets, swing trading, and intraday price action. In range-bound conditions, it helps you identify turning points. Traders may buy when the RSI is around 30, indicating oversold conditions, and sell when the RSI approaches 70, indicating overbought conditions. When mixed with additional tools, you can more easily time entries and exits at relevant price zones, such as support and resistance levels.

Pullbacks offer entry opportunities in trending markets. The RSI may remain under overbought conditions during extremely strong trends, so look for dips where the RSI drops to 50 or lower, and then goes back up to go long.

Day trades and other short-term traders usually use the RSI with shorter n periods, such as 7 or even 2. They can easily spot explosive and quick price movements in the intraday and the short term. For volatile assets like crypto, some traders may prefer to adjust the extreme thresholds to 80 and 20 to reduce noise. Divergences are also extremely helpful in highlighting possible tops or bottoms.

• 14-period for stocks and other general use cases.

• 8 to 10 for crypto and forex.

• 2 to 5 for day trading, with additional techniques for confirmation.

The MACD thrives in trending markets. It uses two exponential moving averages of a security’s price, 12-period EMA and 26-period EMA by default, with crossovers to confirm momentum shifts. Many traders use MACD to know for how long they should stay in a trade, exiting only when the indicator indicates a trend shift.

Indicators like the MACD work extremely well across a diverse array of asset classes. In stocks, it confirms long-term strengths; in crypto, optimal settings can help track fast moves; in forex, it filters noise on daily and shorter timeframes.

The MACD can lag a bit since it is calculated by subtracting the 26-period EMA from the 12th. It is, however, reliable. By trying different settings and periods, you can find the most optimal configuration for your preferred use cases.

• Default (12, 26, 9) is suited for most markets.

• Shorter (6, 13, 5) for faster signals.

• Longer (20, 50, 10) for choppy markets.

Although these two indicators are extremely powerful, they are not free from pitfalls. Here are some drawbacks to be aware of:

To mitigate these issues, you can always include the analysis of chart patterns and other chart analysis tools for identifying key levels for price action. Tuning settings and using effective risk management, such as employing stop-loss orders to protect against bad trades, are also effective. But you can also use the RSI and MACD together to boost your trading system.

Instead of having to decide which one to choose, some opt for combining MACD and RSI to leverage the strength of these two popular momentum indicators. When used together, they can give you a broader view of the conditions in the market.

In the image above, both RSI and MACD indicated that prices could still move upwards after pulling back amid bullish momentum. The RSI went all the way down towards 30, indicating oversold conditions, then started raising again while the MACD line crossed above the signal line shortly after with a rising histogram. This gave traders early confirmation of bullish momentum resurfacing.

Every technical indicator is prone to misleading signals. You can avoid traps by placing the indicator in the overall context.

Before acting on an indicator, run through a quick checklist:

Never act on a single indicator or signal. Strong signals have context, structure, and confirmation. False signals don’t. Use a checklist, your experience, and discipline to separate relevant from irrelevant trading signals. It is always better to miss a trade than to chase a sequence of bad trades.

Both RSI and MACD are great tools to apply to swing trading strategies, as well as more fast-paced trading strategies like scalping.

Although effective, they may serve different purposes and strategies. The RSI performs exceptionally well at expressing when prices move too far, too fast. The MACD, on the other hand, excels at confirming trend direction and capturing the relationship of a short trend and a long trend to highlight when momentum might be shifting.

At the end of the day, the question isn’t which indicator is the best, but which one is better for the current task at hand. In a sideways market, the RSI might be quicker to identify optimal buying and selling points. For riding a dominant trend in the long term and letting profits run, the MACD might be a better choice. The key is knowing what is the right indicator for the right scenario.

You can find success by thoughtfully integrating technical indicators coherently in a trading strategy. Backtesting is crucial to find the most optimal settings and know when to adapt or when one indicator might outperform the other. I invite you to experiment with the RSI and MACD on an array of assets, from stocks to crypto. See how they perform under different conditions and volatility levels. Look for patterns and check their behavior to get a better sense of how to apply the right indicator at the right time.

Which is the best indicator for Day Trading?

It depends on your strategy and personal taste. The RSI performs well in mean-reversion strategies. MACD, on the other hand, can help you confirm the trend direction on the intraday and avoid counter-trend entries. Many day traders might use both, focusing on the RSI to find the most optimal entries, and the MACD to stay aligned with the trend.

How Should I Adjust the RSI or MACD for Crypto Trading?

Given the higher volatility of the crypto market, it is a good idea to expand the threshold for the RSI, from the traditional 70/30 to 80/20. Many traders might also experiment with shorter n periods, such as 9 or 2. For the MACD, shorter/faster settings could be 6 for the shorter EMA, 13 for the longer EMA, and 5 for the signal line.

Why do MACD and RSI sometimes contradict each other?

This happens because their calculation methods are different, meaning they measure momentum distinctively. This is perfectly normal and is one of the reasons why it is important to use price action and broader context to decide which indicator is closer to reality. Contradictions may also be a signal to stay out of the market or use tighter stop-loss orders.

How to Use Divergences Effectively with RSI and MACD?

Focus on crystal clear divergences. If the divergence is visible on both the RSI and MACD, then the signal is even stronger. Always set a stop-loss trigger in case the setup fails.